45+ information on reverse mortgages for seniors

Web Reverse Mortgages allow people from the age of 60 to convert the equity in their property into cash for any worthwhile purpose. Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

The The Top 10 Reasons Seniors Choose Jumbo Reverse Mortgage Loans

Web You need to be at least 62 years old to qualify for a reverse mortgage and loan amounts may also increase as you grow older.

. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Is it right for you now. Find A Lender That Offers Great Service.

American Advisors Group AAG Best for Good Credit. Discover The Answers You Need Here. Reverse mortgages are anything but boring.

Web It all started in 1961 in Maine. Web Best Reverse Mortgage Companies of 2023. This type of loan which enables older homeowners to tap into their home equity while still.

In a 2019 report we found that defaults. Web How Reverse Mortgages Work If youre 62 or older you might qualify for a reverse mortgage. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

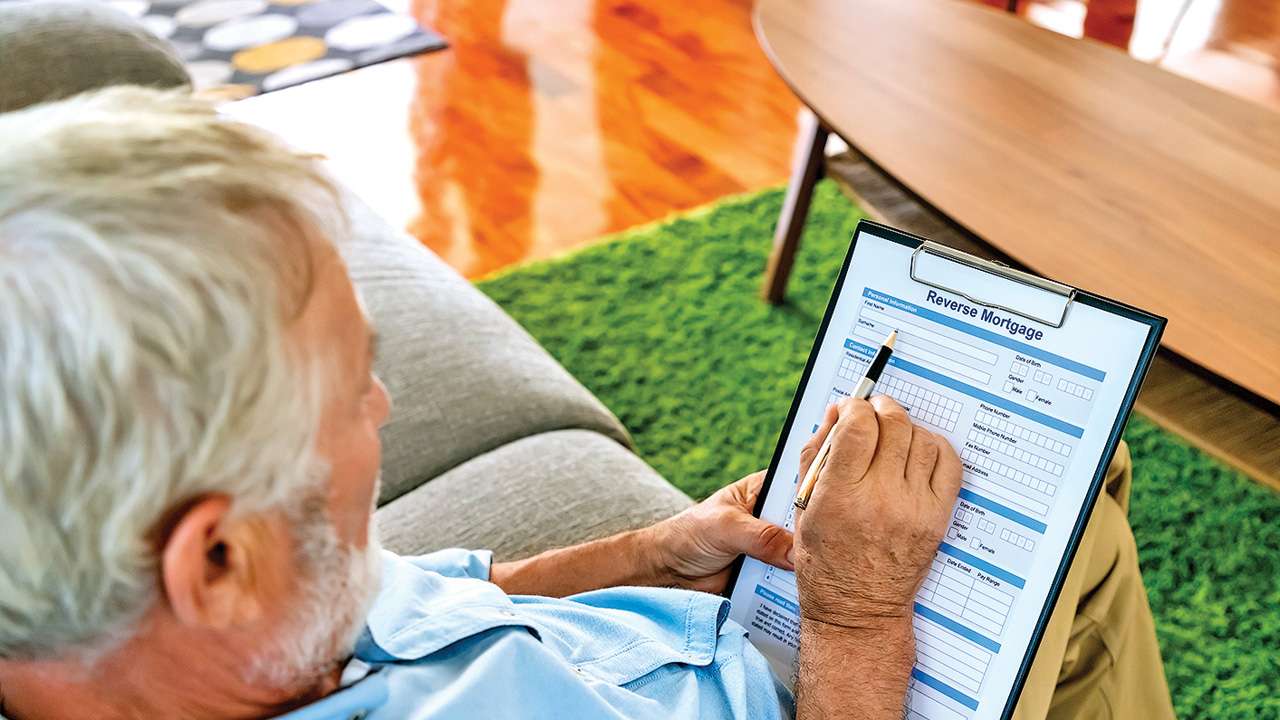

Reverse mortgages come with additional costs. Web A reverse mortgage is a home loan that allows homeowners ages 62 and older to withdraw home equity and convert it into cash. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Web Reverse mortgage loans allow seniors to pull equity out of their homes in the form of a cash loan. These loans have many benefits such as giving seniors access. Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Can the loan improve your emotional and financial well being. Web There are a number of reverse mortgage scams that prey on seniors who need cash to cover living expenses. Web Two of the common benefits why seniors choose a reverse mortgage is to eliminate their monthly mortgage payment and supplement their retirement income.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Compare More Than Just Rates. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Web There are three types of reverse mortgages. Web When a reverse mortgage defaults and the loan terminates seniors are at risk of losing their homes to foreclosure. Best for Ease of.

Borrowers dont have to pay taxes. These are offered by state and local government agencies and sometimes. Your home has to be a single-family home a HUD.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Looking For Reverse Mortgage For Seniors. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

With a reverse mortgage the amount of money you can borrow is based on. Web Reverse mortgages arent for everyone. An Overview Of Reverse Mortgage And How It Works.

Web A reverse mortgage is a type of loan available to homeowners over 62 that allows them to turn the value of their home into cash to help cover day-to-day expenses as they age. Single purpose reverse mortgages. Web A reverse mortgage sometimes known as a Home Equity Conversion Mortgage HECM is a unique type of loan for homeowners aged 62 and older that lets you convert a portion.

It lets you convert a portion of your homes equity into cash. Web A reverse mortgage is a type of loan for homeowners aged 62 and older. Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

However the supplemental income generated from a reverse mortgage can help seniors live better and remain in their own homes. Certain criteria must be met to qualify for a. No income is required to qualify.

Reverse Mortgages Mortgage Rates Mortgage Debt Management

Reverse Mortgage Information For Seniors

Washington Trust Reverse Mortgage For Seniors

Reverse Mortgage Guide The Truth About Reverse Mortgages

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Homeequity Bank Total Reverse Mortgage Portfolio Exceeds 6 Billion In 2022

Reverse Mortgage Eligibility Requirements

Reverse Mortgage Information For Seniors

Reverse Mortgages Using Your Home To Help Pay For Your Retirement The Chin Family

Economic Validity Analysis Of Housing Reverse Mortgages In China The Perspective Of The Financial Decisions Of The Elderly Emerald Insight

How Does A Reverse Mortgage Work For Seniors Goodlife

Homeequity Bank Total Reverse Mortgage Portfolio Exceeds 6 Billion In 2022

Reforms Incentives And Flexibilization Five Essays On Retirement

Understanding The Pros And Cons Of Reverse Mortgages For Seniors Agingcare Com

Reverse Mortgage A Gold Walking Stick For Senior Citizens

531 Reverse Mortgage Stock Photos Free Royalty Free Stock Photos From Dreamstime

With Stimmies Fading Consumers Dip Into Credit Cards For First Time Since 2019 But Only A Little Everyone S Relieved Wolf Street